Who can invest

- Resident Indian Individuals / HUF

- Indian Companies / Partnership Firms

- Trusts/Charitable Institutions/PF

- Banks/FIs/NBFCs

- Insurance Company

- NRI/FII

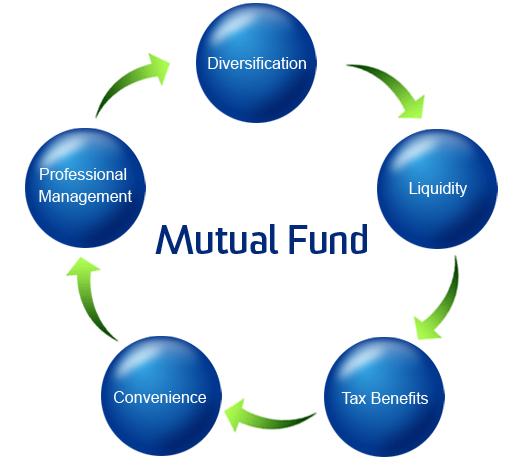

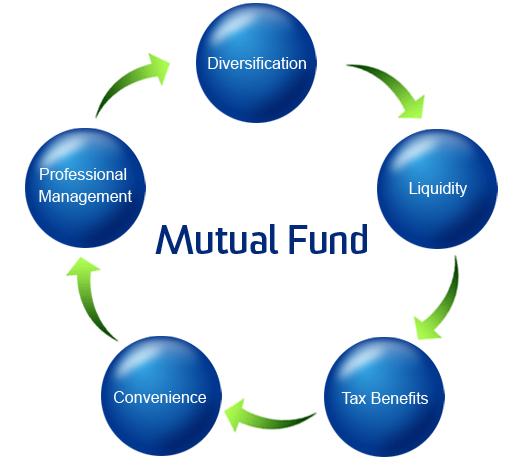

Characteristics of a Mutual Fund

- Investors own the mutual fund.

- Professional managers manage the affairs for a fee.

- The funds are invested in a portfolio of marketable

- securities, reflecting the investment objective.

- Value of the portfolio and investors’ holdings, alters with

- change in market value of investments

Pros and Cons of Mutual Funds

- Portfolio diversification

- Professional management

- Reduction in risk

- Reduction in transaction cost

- Liquidity

- Convenience and flexibility

- No control over costs

- No tailor-made portfolios

- Issues relating to management of a portfolio of mutual funds

Types of Funds classified by nature of Investments

EQUITY FUNDS

- Pre-dominantly invest in equity markets

- Diversified portfolio of equity shares

- Select set based on some criterion

- Diversified equity funds(ELSS as a special case), Capitalisation based funds, Index funds, Sectoral funds, Value Funds, Equity Income or Dividend Yield Funds, Aggressive Growth Funds, Growth Funds etc

DEBT FUNDS

- Predominantly invest in the debt markets

- Diversified debt funds

- Select set based on some criterion Income funds or diversified debt funds, Gilt funds,Liquid and money market funds,Serial plans or fixed term plans, High Yield Debt Funds etc

BALANCED FUNDS

- Growth & Income Funds( strike a balance between capital appreciation & income for the investor)

- Investment in more than one asset class

- Debt and equity in comparable proportions

- Pre-dominantly debt with some exposure to equity

- Pre-dominantly equity with some exposure to debt